I have got a beast of a post here so feel free to answer some, all, or none of my questions…

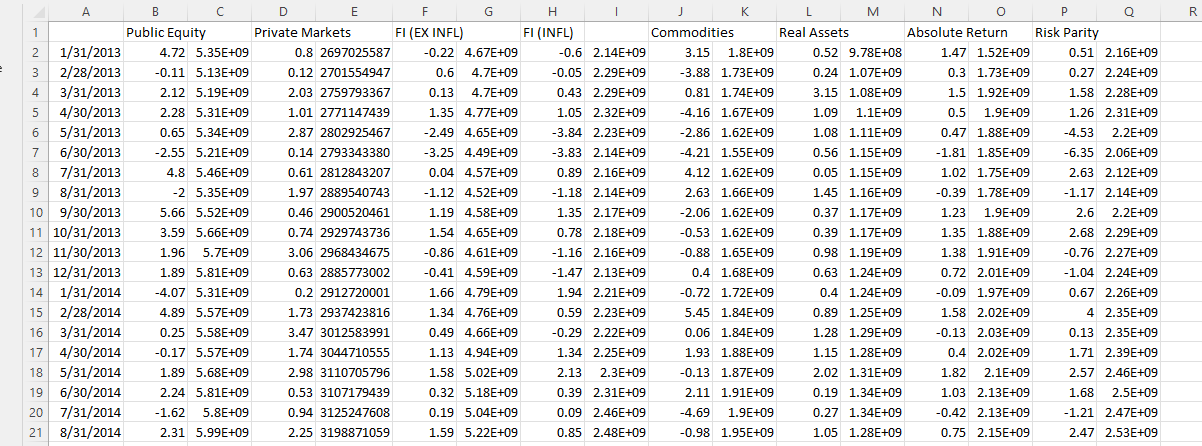

For background, I have a dataset that looks like this picture:

I am attempting to use an LSTM Neural Network to optimize Sharpe ratio by messing with portfolio allocations.

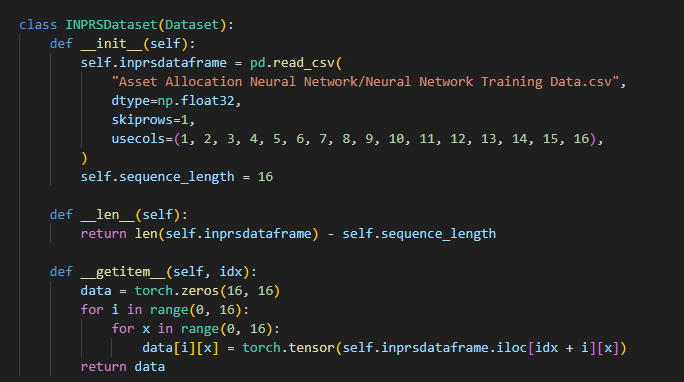

- I am using a batch size of 8, sequence length of 16, and have 16 features as shown above. As of right now I have a tensor of size [8, 16, 16] where it is 16 groups of 8 consecutive time periods. From my understanding it takes 8 months and makes an array out of that then stacks 16 of those on top of each other.

I am wondering if this seems logical to everyone as a way to format my data. It seems almost too simple.

-

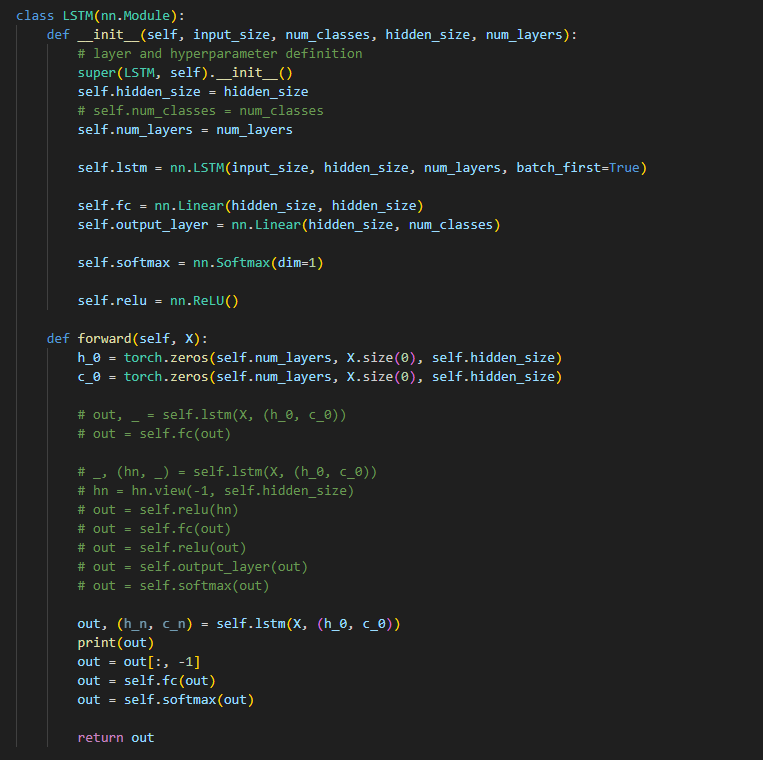

I am having difficulty with the forward function. I have tried quite a few things, so I wish I could attach more images. My goal is to have it output 8 values (maybe in a 1x8 tensor), those being the allocations for each asset class, however, I am struggling with making this happen. Wondering if anyone has any input on the appropriate way to make this happen. As of right now I’m getting very weird shape tensors back.

-

Once I get the data and forward working, I can move on to the Loss Function. I am very confused about how to make this happen. Once I have the allocations I need to calculate what Sharpe that would have given over the period, however, it needs to all be done in a tensor form. Any pointers on making custom loss functions in general?